Opinion 100 Words: Jacksonville Real Estate Market Review - June 2018: So to the Brother…

Expressing an opinion 100 Lyrics:

Jacksonville Real Estate Market Review - June 2018:

So after examining close to 700 properties in the stunning city of Jacksonville in North Florida I would like to give an overview of the state of the real estate market in the city:

1 - The trend of price rises is definitely continuing throughout the city - with more detail below -

This is mainly due to positive and ongoing migration to the city, including military personnel serving in the city's naval and air bases, the establishment of a huge Amazon branch in the north of the city, the opening of new 4 Walmart stores, a continuing drop in unemployment and an improvement in employment.

From an average price of 124 thousand dollars in 2016, the average price in the city is 161 thousand dollars -

Reflects an average increase of 29%.

An index of price increases in the city can be found at the following link:

https://www.zillow.com/jacksonville-fl/home-

values /

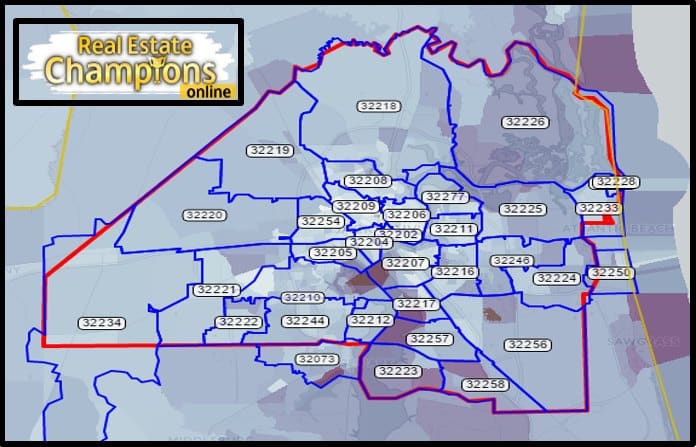

Area Analysis:

1 - The northern part of the city is experiencing a rapid rise in property prices, especially in the COLLEGE PARK, HIGHLANDS, and TURTLE CREEK and ARLINGTON neighborhoods -

There is a very strong building momentum in the area, the proximity to the international airport and the new Amazon branch adds to the popularity of the place -

Properties there are rented relatively quickly in two weeks and demand is high.

We mainly work in focus area 32218,

32226, and 32277.

2 - Downtown - remains as popular as ever - proximity to major universities like FLORIDA NORTH UNIVERSITY leaves the area in high demand, such as the RIVER SIDE complex and colonial-style homes in the area.

We focus on 32211, 32204, 32205, 32207, 32216, 32246, 32225,32224-

And avoid purchase in most crime-ridden areas in Zip Code 32208,32209,32254,32206.

The good areas of ARLINGTON neighborhoods can be noted

, SANS SOUCIE, BEACH HAVEN

And more.

3 - Southern City - Remains Popular As Always -

Prices there are lagging at 10-15% of similar properties in the center and north of the city and constitute suitable land for investors looking for an increase in the value of their assets in the future - because in our opinion the South will infect the North in the next two years.

We focus on 32210, 32244,32257,32256, 32068 and more -

And try to avoid 32073 targeting areas because of increased negative migration from this area.

The popular neighborhoods are CEDAR HILLS, NORMANDY MANOR which I personally love very much, the whole MANDARIN area, and especially ORANGE PARK in some parts of it.

Hope the overview helped those looking to invest in the city -

And most importantly - "Real estate is done in the field or not done at all".!

Link to the original post on Facebook - Works on a desktop computer (To view the post must be members approved for the forum)

I live in Jacksonville most of the year and know the metropolis well. The division into the targets you specified is very coarse and arbitrary.

Even in a certain area you have to know which street to buy and this is well known when you live there and manage the life there and study the place.

For example, 32204 mostly belongs to a lower city and for that reason I also do not come close to a protected vehicle?

In addition, the southern part is experiencing a dramatic increase in prices and the further down south the higher prices and the higher quality places. Homes I bought for $ 30 four years ago cost $ 150 today. The South was the first to experience price rises.

I have houses in the zip codes you defined as crime-ridden places, but when you know where to buy and what to buy, you get a return of 8-14% in good houses and loyal tenants.

Here's an example of the house I live in myself?

Do you buy independently? Or through membership?

very impressive

Nissim Sraya

Assaf Uri

I have a property in town would you like to purchase it from me?