The United States Real Estate Forum works with six brokers who work with various US banking services

Update: Due to the Corona virus crisis, the Fed has lowered interest rates to zero and you can get the best interest rates today!

Our investors have recently received interest rates of between 3.9X and 4.1X

Commercial loans

1. Terms of financing: Each bank has different terms of financing. In most cases, the amount of financing for refinance or flip transactions will not be less than $ 100K for the purchase of the property, but of course each case individually, and each bank has different criteria. We will submit any application to the most relevant banks according to the details you fill in the application form.

2. A large portion of loans can be given up to 30 years at a fixed interest rate. There is usually no penalty for leaving a “panel payout” early plot!

Most banks are willing to refinance a finished property only - meaning that in some cases you will need to take out a hard money loan for renovation, set the end of the renovation to spend the money by refinancing loan. Interest rates change all the time but it is usually not possible to get interest rates of usually 3 to 3 percent for 7 years.

Prerequisites for obtaining a loan for a foreign investor - Before receiving the loan the borrower should:

Hard mani loans

As is well known, interest rates for a bronze money loan range from 10-12% annually + 2-3 points for the establishment of the lending framework.

In a hard money loan most of the lander is willing to finance between 80-90% of the total purchase and 100% on the renovation, but no more than a total of 70% of the total ARV.

Balloon loans

- Regarding Balloon Loans - Balloon loans are different from the hard money loan. A balloon loan (bridging), is a borrower of up to 75% of the value of the property and it is not possible to receive renovation money. This loan has a peak interest rate of 6-8%. Hard Money is a 10-12% + 3 point loan.

- Can't do a repair on any property without waiting for a "seasoning". Israelis have no credit but still cannot give them this capable loan.

- In balloon loans, this "peak price" for a period of 30 years.

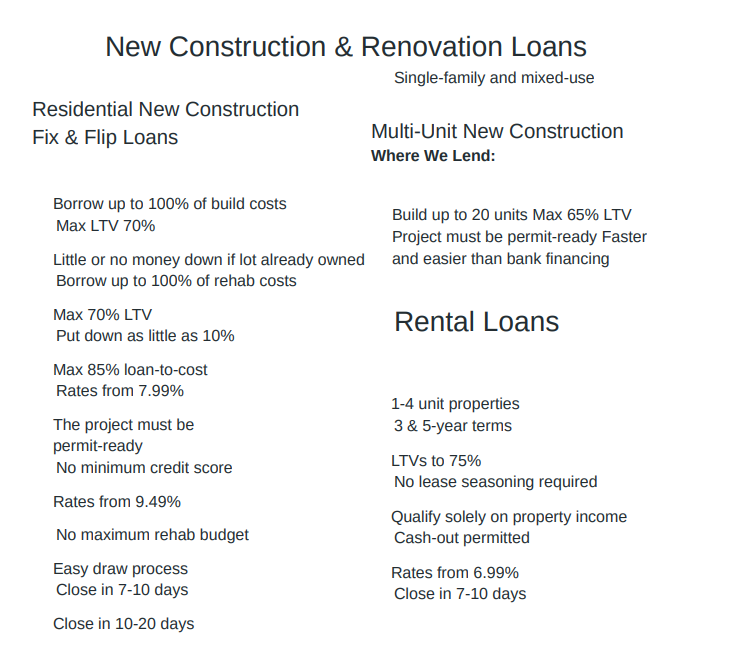

New construction loans and multimillions

Here are the terms and conditions of one of the banks we work with regarding new and multi-family construction loans - but of course we will submit your application to a large number of banks for optimal terms

The documents necessary for the borrower

- Personal finance report

A form that includes the name of the company, existing assets, debts and liabilities, sources of income, information about the loan holders, shares and debentures, real estate you hold, unpaid taxes, life insurance, etc.

In social number - change and you do not have, just enter XXX

By signing, write down your name - Borrowing application form Loan application

Includes your details, property address, details of the renovation, details of the owner and the signatories of the borrower, details of employment, a questionnaire about your background, etc. - Overview of Insurance Requirements - Insurance Requirements This form includes a statement of insurance requirements

- Form details of the contractor This form includes details about your contractor, who owns it, his insurance, the number of projects he is currently doing, his history, recommendations about him and documents that need to be uploaded such as the contractor's insurance, resume, income tax documents, etc.

- Approval document for valuing a property - confirmation of payment of appraisals In this document you are comparing to the bank send an appraiser to perform a price estimate for the property

- Excel List their properties and details For this and you are interested in refinancing several assets, fill in the details of the assets in this Excel - Click here to download the Excel

Can not get all the borrower documents together by downloading this file

Phone Help & Support Forum

In order to receive support and answers online, all the questions must be gathered in the financing forum for foreign investors on the site.

It is important to gather all the questions in one place so that we can maintain efficiency - as well as the advice in the forum on the site was free.

To enter a foreign investors financing forum click here

Loan application form

Fill in the details as much as possible.

We will get back to you as soon as possible to assess the chances of the borrower, and the forms will also be sent to you for manual completion.

Guidelines for applicants and explain what is going to happen after filling out the form

1. The form will be sent to several brokers

2. The brokers do not work with each other - note the name of the broker at the top of the form and contact him with his name only and not the name of another broker

3. We connect you to all conversations with the broker and everything goes through the forum - these are our business partners and you can not work with them directly, talk to them directly, submit them an email directly or talk to them by phone directly

4. In your messages with the broker do not cooperate phone number or email in the application - otherwise your application will be automatically rejected and your card will be closed - you also waste your time - the amount of transactions we transfer to brokers is large and therefore we get preferential treatment and excellent interest rates. With us by contacting you directly - it will not happen, so you have nothing to try.

5. All communication is in response to the emails you receive and only those emails

6. To set up a call, do not share a phone number or ask to be called - you set up the call using the meeting diary on this page or in This link to the appointment log

7. For this and you can not meet the rules number 1 to 6, please do not fill out the form - we are fair to you be fair to change us

8. For this and you will go through the initial screening and it seems that you are eligible for a loan, you will receive forms to fill out. These forms must be saved in their original format - PDF. Please do not scan, take photos, etc.

After all that… Good luck!

Borrowing application form

With the loan approval, you will receive a free Real Smart subscription for 3 months!

[sc name = "RealSmartBanner"]

The subscription that will promote you in the real estate world

[sc name = "WhatIsRealSmart"]

Feel free to fill out the form above for any question

We wish you success in receiving your loan!

site staff.