# Entrepreneur of the Week Natalie Alter # Post 2 ** Possession of a property in the US in private registration or under LLC? ** One…

Natalie Alter

** Possession of property in the United States under private registration or under LLC? **

One of the most common questions asked by US real estate developers is whether to hold the property in a private registry or under an LLC.

I will try to explain in a simple way the concepts that are worth knowing about the subject, and especially - the advantages and disadvantages of each choice.

** So what is an LLC anyway? **

Similar to Company Ltd. LLC is considered a separate legal entity from the holders of its rights.

Those who hold the LLC rights are called ** members **.

The LLC is registered with the Registrar of the LLC in the specific country in which it is incorporated in the United States.

** What is important to know? **

The obligations of the rights holders in this form of holding are under limited warranty.

That is to say - the debt is limited to the amount that the rights holders undertook to invest in the establishment documents of the LLC.

The liability of the shareholders of the company is limited to the amount of their investment in the company, the so-called ** limitation of liability **.

This is the main reason that motivates investors to hold the property under LLC and not in a private listing.

** Why is incorporation within an LLC considered flexible and easier to operate? **

This form of incorporation is considered more flexible and easier for both the LLC manager and investors for the following reasons:

1. Incorporation within the LLC is not subject to company laws and does not require institutions such as a board of directors and a shareholders' meeting at all.

2. It can be determined that a dividend will not be distributed proportionally among the rights holders.

3. The establishment of the LLC and its activities are based on an establishment agreement similar to the establishment of a partnership and not on an official document as the company's articles of association.

4. Limitation of Liability.

** How is LLC registered in the United States? **

A distinction must be made between an LLC with a single member and one with two or more members.

** Single member LLC ** - Held by a single rights holder.

Is considered a completely transparent body for tax purposes in the United States and all of its income and losses are directly attributable to its sole rights holder.

In addition, it does not file reports in the United States.

** With two or more members ** - The holding of the company is conducted in a similar way to a partnership.

* Partnership - a form of association designed to enable a person to work with others to generate income together, regardless of whether the parties to that partnership are individuals or companies, and whether a partnership is registered in the Partnership Registry or not.

The LLC in this case files Report 1065 and gives each member their share of the partnership capital.

Under U.S. tax law, as long as the LLC's account in the LLC is higher than zero, the distribution of funds will not be considered income, as it is a distribution at the expense of funds that the member has transferred to the LLC.

Finally, we need to fill out two reports - Report 1040 which is a federal report (to the US) plus the state level report.

** How is all this reflected in the State of Israel? **

► ** According to Income Tax Circulars 3/2002 and 5/2004 - LLC is a company for all intents and purposes (this even received support in the ruling). **

► ** The Mismatch Problem **: In Israel, tax law treats LLC as a company - that is, profits that are distributed will be considered as a dividend, while in the US the reference is as a transparent partnership.

* Transparent partnership - an arrangement according to which the company's income and expenses are attributed to the shareholders in accordance with their shares in the right to profits in the company.

* Dividend tax - a tax imposed on a dividend distributed by a company to its shareholders.

In Israel, receiving a dividend is taxable income like any other income.

The result: an Israeli resident will pay taxes without having any income under Israeli law.

In the future when the profits continue we will see them as a dividend without the ability to offset the foreign tax.

► ** Solution proposed by the Tax Authority under Circular 5/2004 ** ** - As long as the LLC is transparent in the United States, its rights holders may report its income in Israel on an ongoing basis and use it as a credit for foreign taxes paid in the United States. After that, the distribution of its profits is not dissolved. Must be consistent and take the same approach every year, starting with the first year.

► ** Income tax reserves the right to claim that the LLC is managed and controlled from Israel and is therefore considered a resident of Israel for tax purposes. ** In this case its income will be taxed on corporation tax in Israel (after granting a foreign tax credit).

Obligatory position in Report No. 16/2016 - A resident of Israel who owns a non-Israeli entity, which is considered in Israel as an entity that is not "transparent" for tax purposes in Israel and on the other hand is considered a "transparent" entity abroad (such as LLCs or LLCs in the US). May not offset losses incurred in the activity of the foreign entity from its taxable income, or from the income of another corporation in its possession, even if it is considered transparent abroad.

Obligatory position in Report No. 50/2017 - Implementation of the arrangement set forth in Income Tax Circular 2004/5 for the purpose of crediting foreign tax only: Attribution of income of LLC corporation to a resident of Israel who owns this corporation and who chose to implement the arrangement set forth in Income Tax Circular 5/2004, in a way that allows him to report The corporation's personal income will be for the purpose of crediting foreign tax only and not for any other matter, including exemptions attributed to the individual, and special tax rates given to the individual.

The IRS published and strengthened its position that the view is for the purposes of offsetting foreign taxes only and his opinion was heard in the above positions.

** Bottom line - you can view the LLC in Israel only for the purpose of tax credit! **

** In summary **, these are the pros and cons of holding the property under LLC:

Advantages:

Align line with US taxation in case of profits.

Exploitation of foreign taxes.

3. National Insurance has determined (2017) that where an examination shows that this is income that an insured person has from an LLC type, this income will be tax-exempt income.

Cons:

No authorization to transfer losses to the personal report in Israel.

2. Inability to offset losses between LLC and LLC.

Activation of Circular 3/5 (credit of foreign taxes paid in the United States as a condition of current reporting) on the day of entry into the investment and inability to withdraw from this decision.

4. For the income tax position, it is not possible to choose the 15% route on rental income - there are no individual benefits.

Hope you stayed with me until the end!

It is important to remember that all the processes listed here are managed by the accountant.

One has to choose the right person for the task, and yet one should know the concepts and understand the meanings.

If you got lost in the middle, and the summary did not put you in order either, I am always available for questions.

Natalie

Mail - [email protected]

LinkedIn - https://www.linkedin.com/in/nataly-alter-9117878b/

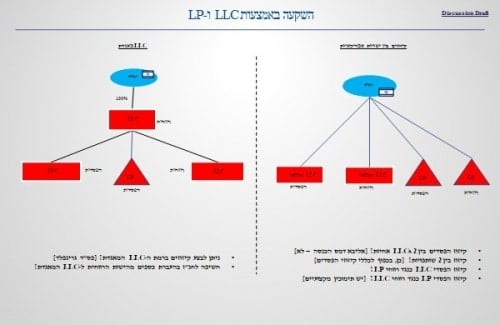

* Attached to the post is a diagram showing the main points.

The original responses to the post can be read at the bottom of the current post page on the site or in the link to a post on Facebook and of course you are invited to join the discussion

Thanks for the comprehensive article. I learned new things.