New housing data…

New housing data

Reuters opened the week reporting that housing starts jumped 22.6% in July, the biggest gain since October 2016. No wonder lumber prices are skyrocketing. With this increase, Reuters noted, homebuilding is only 4.5% below February 2020's pace of 1.567 million units.

Nicole Friedman of the Wall Street Journal (subscription required) last week reported 25% increase in house sales, the highest increase since December 2006.

Source: Wall Street Journal

Friedman points out that "buyers are willing to move away from cities, now that many workers don't travel every day. The pandemic has spurred some households to live closer to family, or somewhere that offers more space with so much time spent at home." But more on that later.

Anna Behney of CNN Business joined the conversation, noting that this is the second month of double-digit jumps in home sales, underpinned by low interest rates and the desire to move from major urban centers. And don't forget about low inventory, which contributes to higher prices in high demand.

In the multi-family market, things are looking up as reported by Victoria Hodgins of "Globe Set" (subscription required). Specifically, Hodgins reported CBRE data showing "significant increases in nondisclosure agreements signed on industrial and multifamily properties in the second quarter." However, CBRE data warns that this market still has "at least a three-year journey to pre-virus risk levels."

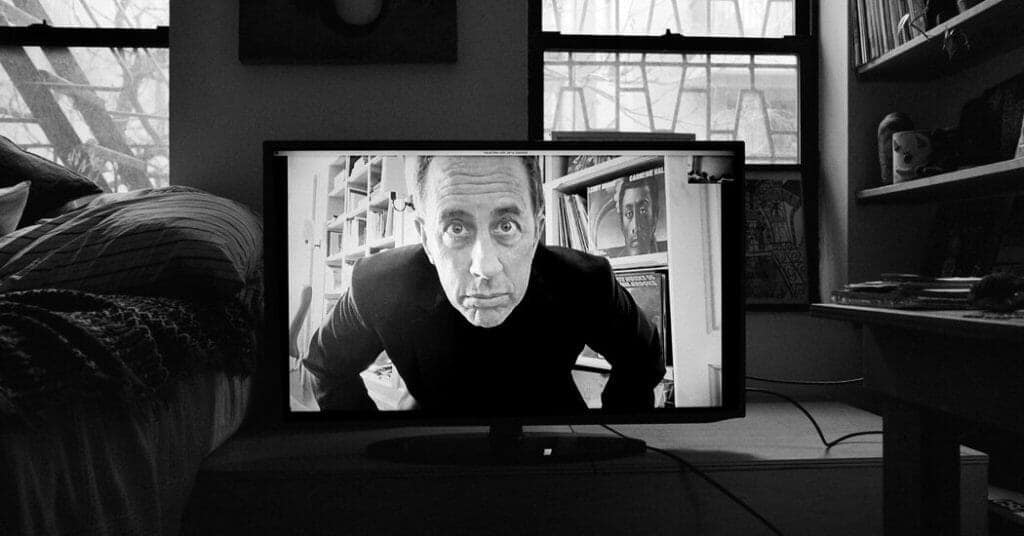

?? Seinfeld does not laugh

Jerry Seinfeld is crazy. In his latest piece recently published in the New York Times, titled So You Think New York Is 'Dead,' Seinfeld discusses his opposition to the thesis that people are fleeing the Big Apple. I'll let Jerry speak for himself:

"He says he knows people who left New York for Maine, Vermont, Tennessee, Indiana. I've been to all those places many, many, many times over many decades. And with all due respect and affection, are you... kidding.. me?!"

"There's something else stupid about the article about 'bandwidth' and how New York is running out of steam because everyone is 'swimming it all out'. Guess what: everyone hates doing it. Everyone. Hates."

"This stupid virus will give up eventually. The same way you have. We're continuing with New York if that's okay with you. And it sure as hell is on its way."

Well, Jerry, the data is not with you regarding this at the moment, but I can not disagree on the importance of New York as a cultural and economic center despite any future or future sexual outings.

Furthermore, in an excellent piece last week in the Wall Street Journal (subscription required), Kathryn Clark reports that "the Covid-19 crisis has delivered a stunning gut punch to New York City's luxury real estate market, putting downward pressure on rates that exceed both the economic crisis of 2008 and the period immediately after the September 11 attacks. "

Source: Wall Street Journal

CNBC's Kevin Stankiewicz reports on an interview with real estate developer Don Pebbles, who notes that "I think eventually New York will come back. It will come back differently. It will be somewhere else and it will be much cheaper. I think it will take New York about a decade to dig it out. maybe more. But it won't be soon. "

And the taxation proposed by state in the city does not help anything.

Responses