The credit rating revolution is coming to Israel in the coming months. are you ready?

In the end it will affect all of us at the level of

Accepting loans on the right terms, according to our rating.

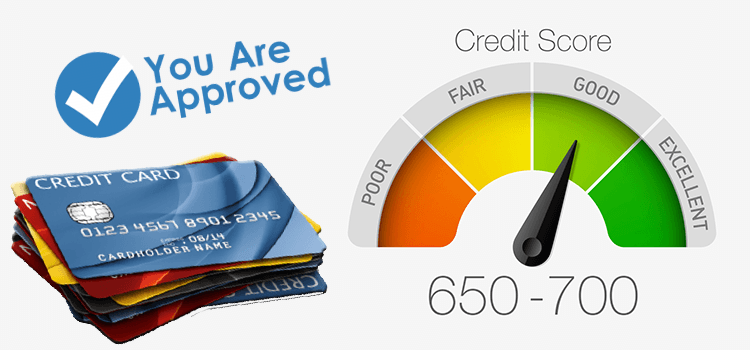

Personal credit rating is a score given to individuals,

Expressing their repayment ability. This grade actually

Provides banks and credit entities with insights into the relationship

To you - should I give you credit? are you

Returning your debts? All the information about you

In fact, the credit score is weighted accordingly

They give you credit and set the interest rate.

The more confident you are in the eyes of the bank so the interest rate

You pay will be lower. ??

This ranking relies primarily on history

Your finances, your equity

(Assets and liabilities), and financial conduct

You have different authorities (do you pay?

At the time of accounts, whether you have unpaid debts and more).

But like any rating - even this ranking has weaknesses -

Not all information is available, not all information is up-to-date, people

Can evade "obligations" and even hide distress

Financial - Fishman has done it for many years - you

Do you think someone would give him a low credit rating?

Definately not. In practice no one really knew what his condition was -

Simply, did not know how to appreciate his assets (and his debts);

And beyond that - it is not always possible to connect a private person to

Society, but if society is in bad shape and private person

There's actually a fortune - how will its rating look?

In separate entities. But the court has already shown us

He knows how to lift a screen and connect the company with

The private person, and obligate him to inject money into society,

Especially if it turned out there were smuggling of assets.

There are three agencies in the US market

Rating (government controlled) updating data

And information and matching personal ratings. The information they are

Receiving comes from all credit card companies, banks

And financial institutions. This is ongoing information

By means of which a customer portfolio is produced in the rating companies

Which is continuously updated.

And this information is translated into Zion and actually returns to them

Credit institutions that examine customers' repayment ability.

Customers, more accurate borrowers, are tested at each point

The time when they seek increasing credit, loan,

Credit card, designated car loan, renovation,

Mortgage course and more. Your score also allows for marketing

Dedicated credit card companies - say for example a company

The credit is interested in approaching all the safe borrowers

In a proposal to increase the framework at a very low interest rate,

She can get the people out of the pool and contact them.

The credit rating is determined by the rating companies

According to payment history; Accounts

Credit open; Use of credit is utilized

And available credit; The seniority of your credit portfolio;

The requests for credit mainly in the past year;

Problems - bankruptcies, unpaid debts, etc.

Credit to: Avishay Ovadia.

Here is 11