When you eat look at your plate -

This is one of the sentences I remember from my late mother, and it is very relevant to the world of real estate investments, especially for beginning investors.

To illustrate my intention, I will do so through an example of a simple transaction that occurred in Israel, but the story is probably valid wherever we make / offer / embed deals with Israeli investors.

One day I was walking around one of my investment areas, and I met one of the brokers through whom I get occasional deals. During a light-hearted small talk he suddenly threw at me: "Listen, I have a deal that might interest you."

I listened to him, it was a deal that on the face of it sounded great to me, a deal at a price of NIS 200,000 below its market price.

The market price for the area was: 670,000-680,000 NIS

He offered the property for: NIS 480,000

And asked for a brokerage fee of NIS 40,000, an important detail that we will return to later.

At that point, I had a few investors who I consulted and accompanied, and I thought this property would be great for them, especially when they have no purchase tax and no sales tax.

Inside the apartment:

As expected from such an apartment, it was not inhabited for several years, the apartment was neglected, worn and old furniture and piles of dust on the floor, the years it stood empty showed their signs. It took me a minute and a half to tell the broker 'I bought'.

Investor Response:

Now I have started to pass the information on to investors to help them advance the deal.

That same day I brought in 2 investors, they were horrified by the look of the apartment, and that was understandable, they were not skilled enough to see the potential in the walls. After reassuring them and showing them data from the tax authority on similar transactions (in the building itself the same apartment was sold for NIS 685,000 a few months earlier) in the area they calmed down in this aspect.

However, they refused to take the deal, the refusal came after I mentioned to them that the broker is requesting a brokerage fee here in the amount of 40,000 ₪ Which is 8.8% of the closing price I received.

They made a crooked face, and began to respond exasperatedly, one of them even condemning the mediator for his demand.

In Israel it is customary to take a commission of 2% + VAT, hence their expectation was to pay a minimum commission which is 10,000 NIS + VAT.

I explained to them the logic that a broker has no interest in taking such a ** bonanza ** deal here, and that I recommend that they pay the broker a heartfelt, as it will only encourage him to bring them more deals in the future.

Another investor I brought in the next day, who restored the ritual and also refused.

Spontaneous purchase of the apartment:

After 3 Investors, I realized that they were not only immature to purchase the property, but that their entire business worldview was distorted and incorrect. Although I did not plan, I spontaneously decided that I would purchase the property.

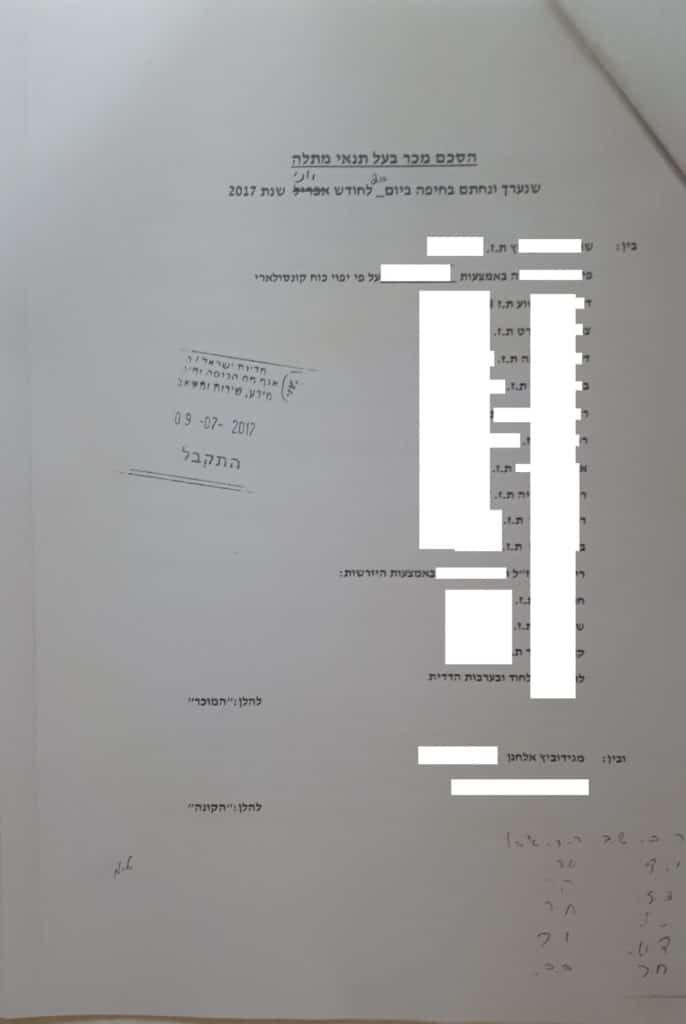

I managed to make another small price tag and reached an agreement with the sellers (which I only met during the contract) through the broker for a price of 450,000 NIS, with the broker I reached an arrangement that I will pay him 28,000 NIS at the time of purchase, and I promised him that when I rotated the property And there he will receive the balance - he agreed❗

Why sell at 200,000 below market price❓

There are always the scripts that tell me, why do people sell you cheap, what are suckers ?!

Whenever there is a sale below market price, there is some story behind the deal, sometimes these are inheritance struggles, or inheritance complications (as in post 3), divorce and more. This time it was not the story.

In this case the story was that it was the grandfather's apartment of the sellers who are Swiss at all. Their mother bought the apartment for her father (grandfather) years ago so that he would have a place to live. The mother died in two years and a few years later her grandfather died. Since he was married to a Swiss he could not inherit the property for the reason Prohibition on transfer to foreigners, And therefore the apartment was named after his children who are also the legal heirs of the mother and by virtue of being Jews according to Halacha and the Law of Return, they were able to inherit the apartment.

The meeting with the heirs at the signing -

When I met with the heirs at the signing of the sale agreement, the seller's representative (one of the brothers who came from Switzerland) told me that he knew he was selling the apartment well below the market price and wished me success.

Surprised, I asked him why he was selling the property to me at that price. His answer was honest and simple;

"I do not invest in real estate, my mother bought this house for my grandfather at the time for NIS 450,000, and our whole purpose is to return the money home, there is no purpose here to make a profit." The truth is I was impressed by the sincerity.

The exercise-

I realized this property right after about half a year at a price of 640,000 NIS without making any move in it. I just threw the furniture and swept the floor. In fact, if I had renovated the property for 100,000 NIS, it would have been realized for 850,000 NIS. , Which was easy for me to prove from parallel publications that were in the area and by my very experience, and it made it easier for me to sell to the next investor in line, I actually sold a profit potential to those who wanted to do a small flip or return to those who wanted to hold.

Looking back, I made a mistake -

Later when I thought about this deal, I think I made a mistake and did not have to realize, but renovate myself and rent the property, a rent that would have brought me a return of 7.3% on the whole deal (including purchase tax, renovation and attorney) and cash flow of 2000 NIS And a little per month, which would have been added to my total cash flow from the rest of the assets. The reason I sold is because I spontaneously purchased the property with money I had earmarked for another investment so I hurried to extract it from the deal.

Not bad, learn and move on

Investor's mistake-

Remember the sentence above of my late mother ?!

This is exactly why they did not invest. The deal was great for them, but the critical mistake they made was to look at the broker's plate. They are not about the profit from the deal, which would have reached around NIS 140,000 (after expenses) and if they had made a quick move or reached the area of NIS 240,000 (after expenses) if they had renovated. They were more disturbed by how much the broker profits from the deal. They looked at the broker's pocket and not their pockets and this is exactly where they failed❗

Moral-

You can't make money alone, if you want to make money, if you want to make a lot of money - make sure everyone who works with you and around you also makes money❗

There's also another side to the story -

When I advertised the property for sale, after I bought it, fate wanted and the owner of the apartment that was purchased a few months ago for NIS 685,000, came to be interested.

The truth is that I blamed him and encouraged him to purchase the property because the more apartments you have in the building, the more power and foothold you have in the building.

He desperately wanted and was debating to buy the apartment, until ……

He made an inquiry with the tax authority and saw how much I had purchased it, from a point where the negotiations were in the area of NIS 640-650,000, he reduced it to the area of NIS 580,000.

When I asked him what happened, he (politely) told me that he was not a sucker, and that if I purchased 450,000 I would not turn around.

The deal didn't work out, he missed and big time, also for the reason he was looking at my pocket and not his pocket.

In pictures-

The handshake after the agreement is signed (not all blondes), in the status of lawyers.

- Table of Tax Authority reports: in red a similar deal purchased a few months ago for NIS 685,000, in yellow - my purchase for NIS 450,000 (NIS 150,000 per heir / brother), in green my realization after a few months for NIS 640,000.

- SMS message from the guy who dropped the deal because he saw that I bought for 450,000 NIS.

A very true post.

I am a real estate agent in Florida and know your story about my meat, I have experienced a lot of buyers who have bothered them that someone along with them is making money so they lost. Anyone who understands the field knows that in the end the realtors are the ones who should be chaperoned in order to be the first to reach a Bonanza deal.

Excellent post !!!

So true

Thanks

Very relevant to Holsalers in the US. Once a new Holsler I knew "interviewed" me and asked if he was buying at 20k a house worth 100k and selling it to me at 60k So how would I feel? Of course I replied that I was glad we were all earning. It was important for him to know beforehand because he often felt the way he looked at the plate.

It is human nature to make accounts of others, it turns out.

This is something that requires work. Dan Arieli also did an experiment on it. There are certain "fair" standards that exist in people and it is difficult for them to look beyond it to the profit line.

I add the "all time classic": "But we will pay full interest money if we take a mortgage"

I liked. Thanks for the post

Elhanan and all the rest of the audience here - although this is an "Israeli" post and not an investment in the US and I was interested in asking Elhanan mainly but to anyone who understands him - what other tools does the investor have to buy with no liquid money? (Maybe if any questions but trust there are some here who would love to share ways) Thanks

Oh how much is the morality of the mind that deserves to be in the Ten Commandments of the investor

Thank you Elhanan for a helpful post, my friend!

A common case in Israel, it is important for people first of all how much you earn and only then how much they earn.

At the same time, I do feel that this phenomenon is starting to change significantly and it is completely gratifying for all parties.

So true!

I try to explain to a lot of people around why I'm not so interested in the reason why they sell below market price (after testing of course) and that they don't always come knocking.

And of course, why pay the broker ..

It's hard for people to accept this ..

Thanks Elhanan.

I loved how the first and last sentence

(Roughly) communicating with each other

Many times we humans or perhaps Israelis have a tendency to look at

"What does he gain from this?"

Why would I pay the broker 2,3,4

Instead of seeing situations of

win win

He earns that it's a good deal and therefore takes more brokerage

And you, the investor, make a good deal on the market

I loved how the first and last sentence

(Roughly) communicating with each other

Many times we humans or perhaps Israelis have a tendency to look at

"What does he gain from this?"

Why would I pay the broker 2,3,4

Instead of seeing situations of

win win

He earns that it's a good deal and therefore takes more brokerage

And you, the investor, make a good deal on the market

Great, Bull! People are scared that someone else will make money on their deal, they don't realize everyone is making money !!!!

It's not easy to implement but you're right.

By the way, in the green the apartment is 75 meters, the apartment you purchased is 52 meters

Thank you!

Excellent post! Israelis have a fucked up garden inability to spruce up another. I loved the writing and the business vision

Good luck to many more deals, well done!