How much tax do you pay in the US? 1. On rent? 2. On capital gain? How much tax after that (if at all…

How much tax is paid in the US?

1. About rent?

2. About capital gain?

How much tax then (if any) should be paid in the country?

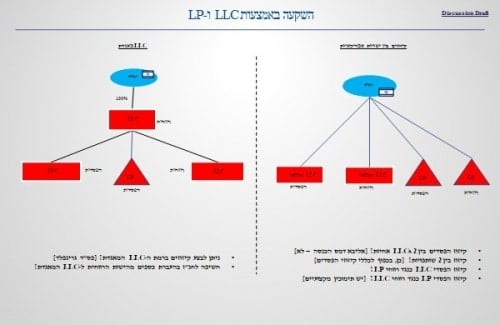

The intention of an LLC is incorporated.

The deal is for 5-6 years of rental.

And finally there is a sale (hopefully for profit).

All through Israeli society.

Thanks in advance for the answers.

Hi. Hello..I am an accountant…

And will answer you as I answered here before..and I also posted posts on the subject…

According to your wording it is a group investment…

The 15% track is irrelevant !!!!!!

Again… Not relevant !!!!!!

Pay 31% tax on rental income (this will offset the tax in the sand)

At the end you will pay a capital gain tax to sell the property 25% ..

There is a coupon in the forum for an annual report

Also and without connection, you are invited to a tax consultation/meeting on the subject (which includes examining the suitability of the investment for your needs)

For those who respond,

I'd love to see how it's calculated.

For example: annual income from rental 3,000 $

Capital gain at the end: $ 5,000

In Israel, the 15% track is irrelevant when it comes to LLc.

Income from taxed rent according to your general income level in the US.

Long-term capital gain (if you hold for more than a year) is 0% -20%.

There may be additional taxation at the state level.

In Israel, there are 2 tracks, which are gross deduction minus 15%.

Track Two, with recognition of all expenses and tax deductions paid to the U.S. by non-income tax brackets, is progressive starting at 31% (assuming you are under 60).

Capital Gains Tax is a supplement to 25%.

Ben Ginati

Ido Neuman