Hard Money - a dubious loan from the gray market?

Hard Money - a dubious loan from the gray market?

Hard manic and gray market

When an investor hears the words Hard money lenders, the first association that usually comes to mind is "dubious lenders - a gray market", who run their business in dark alleys for a fee.

Admittedly, in previous years there were quite a few criminal entities that engaged in loans of this type. In recent years, however, "hard money" loans have been monitored (regulation).

Fortunately, the criminal organizations have abandoned the "hard money" field because they are now supervised, as mentioned. Admittedly, the stigma about Hard money lenders, still exists.

When I introduce the "hard money" product to Israeli investors, the question I am often asked is, what is the interest rate on a loan of this type?

When I answer that the amount of interest is 12%, I often hear accusations: is it "gray market" interest?!?!.

How could you be charging such a high price for a loan that is actually a kind of mortgage? Often the call breaks off immediately after the high interest rate is displayed.

For those who still choose to continue the conversation politely, I immediately ask, in what combination do you usually purchase flip properties in the United States?

Often the answer I get, "I buy together with a partner." I continue to make it difficult, then, how do you divide the profits between the partners?

Almost always the answer is the same. We divide by 50-50 earnings. I continue to harden. So, with the Hard Mani loan, do you pay 12% interest over 50% of a profit sharing with a partner?

"Wow, interesting," is usually heard on the other end of the line. Therefore, when going into the girder thickness, and starting to analyze the interest rates, one should check the existing data of the property and the capabilities of the operating contractor.

What is the nature of the renovation? What is the time frame for this kind of renovation? Should a massive renovation be done on the property or whether, replace a toilet and kitchen and the property can be raised to market.

So What Is A Hard Money Loan Really?

The Hard Mani loan is such a short-term loan secured by the lien of the property.

Today and in contrast to the past, they are funded by private investors (or a fund of investors) as opposed to conventional lenders such as banks or credit unions.

The loans are usually for a period of 12 months, but the loan term can be extended to two years.

The loan requires monthly interest payments only and the principal payment will be made at the end of the period (ie with the sale of the property and / or repayments).

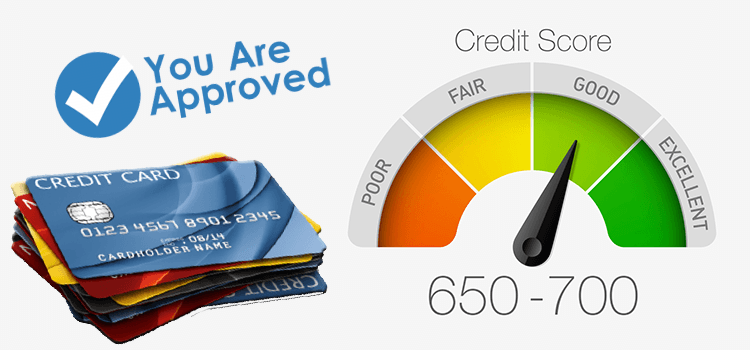

Most often, the loan amount will be determined based on the value of the property after the renovation, with most of the weight given on the value of the property rather than on the investor's credit line.

So even if the regular bank rejects the investor's request, Hard Mani Lender may approve a loan of this kind.

It follows that, in Ravium cases, it is preferable to use Hard Mani rather than a partner, when the loan period has to be taken into account and what the value of the property will be after the renovation.

In addition, even in cases where the banks reject the mortgage application, Hard Mani Lender may approve the borrower to the investor.

The original responses to the post can be read at the bottom of the current post page on the site or in the link to a post on Facebook and of course you are invited to join the discussion

Question from the other direction: If I have liquid capital and I am interested in becoming a lender who receives 12% of his capital - how do you enter the field?

Moshe Orange Thanks for an interesting and interesting post. As a rule I agree with the above and certainly if the bottom line insights.

At the same time, there is a certain deception compared to working with a partner ("You will give the partner 50% and the lender only 12%").

As a true and perfect principle when it is

Success Oriented. Leverage in definition.

However, in the event of a loss, the lender does not share the loss with you and even earns its 12% (or the asset).

And again - leverage.

In addition - in a partnership, one of the two partners does not have a mortgage on the property (what exists in the loan).

To sum up - do not disagree that you wrote (and do not pretend to understand it too much), but in my opinion it is important to reflect to that potential investor, the full picture, and then he will do his account.

Yafit Levin

There is no doubt that given a situation where there is no other option, then hard money can be a good option… especially with looking at the potential future profits from employing short-term flip. Of course lenders have more risk in a hard man loan so the risk premium is higher… and of course the interest can reach three times a regular mortgage in the bank, the only part here is to look at other alternatives before… HELOC allows you to spend short term interest only… Refinance can be a good option to spend money (if the interest rate in the market is better than the interest rate taken on the mortgage) .. In my opinion one should check before other options before turning to expensive alternatives

For this there is a commodity cash advance