US Real Estate Investing: 8 Reasons to Put Money in American Multifamily How Housing Complexes Become…

US Real Estate Investing: 8 Reasons to Put Your Money in American Multifamily

How have the housing complexes become the hot real estate trend of 2019 and how can you join the celebration even without huge sums?

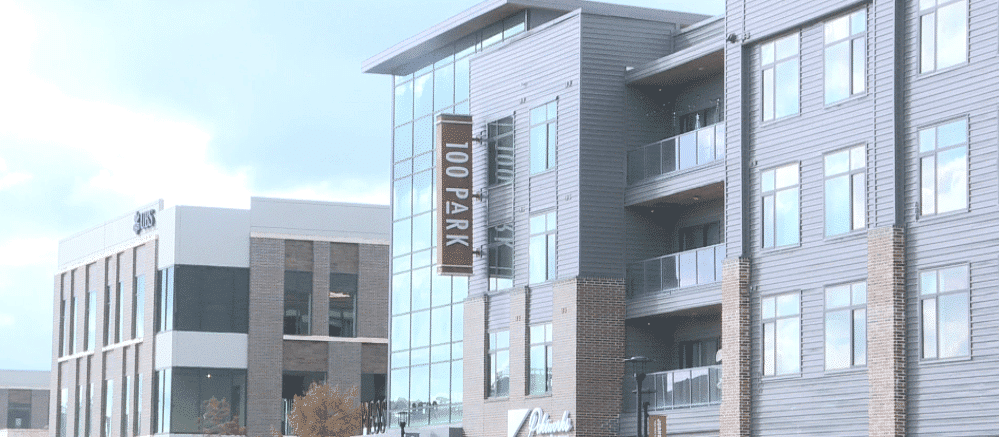

Big investors already know: One of the most attractive real estate markets in the US today is the multifamily complexes. The multifamily is a housing group with all the necessary services for the benefit of tenants, which includes - among other things - a swimming pool, sports fields, playgrounds, bicycle and walking trails and more, all in combination with regular around-the-clock maintenance services. In most cases, occupancy of these assets is over 90%, and is considered one of the most prominent investment trends of the coming year, with a stable market and a high growth forecast for the coming years. These are the reasons why multifamily assets have become the darling of investors:

1. Because the rental market has grown at a dizzying pace

The US housing market has undergone a major change since the watershed, the crisis of 2008. “If, until the crisis, we see that the percentage of homeowners was 65% and the percentage of renters was 35%, the trend today is different. We are already talking about 40% renting apartments, where the market is going. Among the strongest areas of the multifamily can be found Atlanta of course, Georgia, North Carolina, South Carolina and Florida, ”says Lyle Lansdell, CEO of Praxis Capital, a real estate investment firm specializing in the US And especially in multifamily assets. This is Praxis's fourth collaboration with the Israeli fulfillment company, Israel's leading real estate investment company.

2. Because the housing market is flooded with Y-generation who do not want to "finish" like their parents

The psychological aspect of the lion's share of the U.S. population has a great deal of weight in the change that is undergoing the residential real estate market. “Many of the tenants who live in our projects are 20-plus, who experienced the crisis as children or teenagers. Think of a 27-year-old who was 16 in 2008 - he saw his parents drop off their property and lose everything. Young people today do not want to finish like their parents, they are scarred by it. They understand that owning an apartment does not guarantee a future, so it has gone on to become an owner of an apartment, ”explains Forrest Corral, vice president of investment at Praxis Capital.

The original responses to the post can be read at the bottom of the current post page on the site or in the link to a post on Facebook and of course you are invited to join the discussion

Again Fulfillment ??

Does something really think it is the leading company ??

With all the failings experienced by investors ??