Long-term real estate investment

Long-term real estate investment

Most of us are all here, with an interest in this very diverse area called real estate, because we understand that investing is a marathon, not a sprint.

Just as there is no easy money usually in the real world, even when it comes to real estate, one has to work hard enough, and creatively, to find the right deal.

Throughout our lives, everyone will find the profession and the specific way in which he will earn money, either on a salaried salary or independent.

You can make money in brokerage, as well as in flip transactions, and in a variety of investments in various and varied fields in real estate and beyond.

But there are periods when the market is declining, and there is little money, and they change jobs, or they move, and people do not buy, so there is no brokerage, and there is no flip.

And therefore need savings, and especially need investments.

You have to look ahead, not a week or a month, nor a year or two.

Investments of this kind are for decades, they change, and are updated, and need to sit in many different places.

So where should we invest the money to which we have access?

An organized portfolio, experts say, spreads a small number of high-risk investments. Such as FLIP transactions or investments in Startup, shares of risky companies on the stock exchange and also in foreign exchange.

Most investments in the portfolio, then, range from securities to low-risk equity funds and bonds (which at best preserve the value of our money relative to inflation), to medium-sized investments, such as large companies in the stock market, or long-term real estate transactions. Significant profits.

This year is 2019, what do we want our money to do up to 2040?

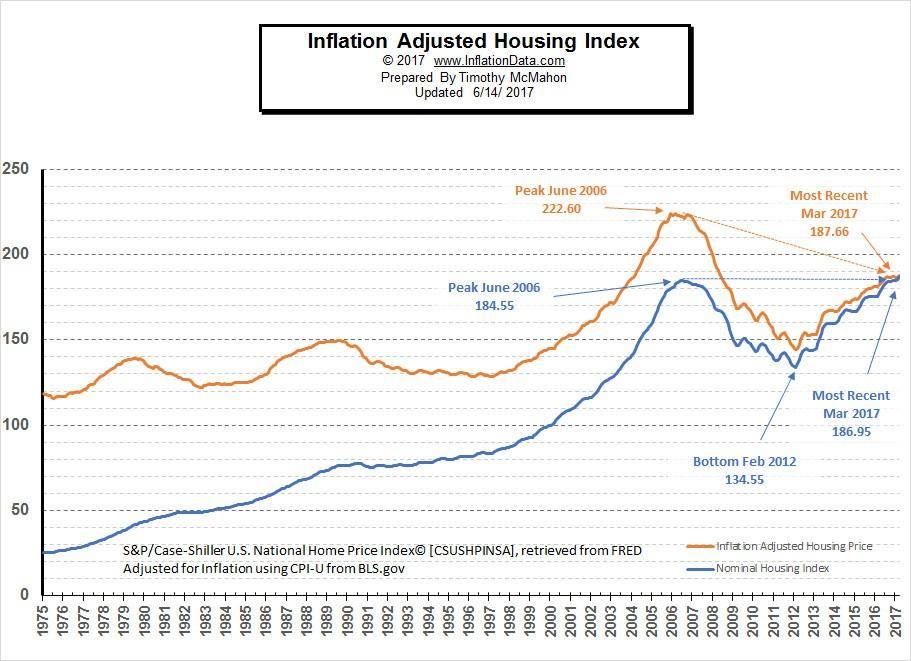

So 20 year is a long time, and we really have a better way to understand what will happen ahead of time, except to look back (see attached images)

The rental market, and the shopping market of homes, will rise.

Maybe not in the crowd, but steady enough to hold our money for the future.

And therefore the place to look for the profit, is not only an increase in the value of the property, but the rental over time.

When we find a house that is below the market price, in reasonable condition, in an area with population growth expectations, and with enough growth engines to justify further development of the area: sports halls, hospitals, schools, universities, cafes and restaurants.

And as long as our target rental is above the 10% profit percentage. In the long run, it will be hard for us to lose.

How do we know that we have found a house that meets the criteria?

We'll talk about some ways you can verify data from home before sending someone to the field.

Thank you for reading, and see you in tomorrow's post 🙂

The original responses to the post can be read here below, and of course you are invited to join the discussion!

- Dude your every championship post. Do you feel like talking to me from my mind or reading my big brother who taught me the field? Well done?

- Nir, a great post with value, is backed by professional graphs.

- There are a number of non-negotiable investment channels such as p2p, hard money and investment funds that enable a good return on risk / good chance.

- Investment details

- Achla Post.

But the ancient graphs 2014-2017 and do not reflect a current snapshot. - Ahla Post and excellent access to the investment world.

Successfully !! - All your posts are talking about 10% Yield..As if it's guaranteed or it's the minimum

- I liked. Always when I tell people that there is nothing like a realtor. They pull out that the stock market is doing more. When in fact no one takes the entire portfolio and invests in stocks. In reality, most of their money is at best invested in bonds and in the most realistic case lies in financial funds that make a quarter of a percent a year.

- Post Championship !! Thank you

- Nir Sheinbein Thank you very much for the very interesting information

- king

- 10 goal rental percentage. This is the main problem for me, it is very difficult to get this data in the normal conduct of regular payments to a management company, insurance company and a host of additional costs that take half of the rent.

I liked. Always when I tell people that there is nothing like a realtor. They pull out that the stock market is doing more. When in fact no one takes the entire portfolio and invests in stocks. In reality, most of their money is at best invested in bonds and in the most realistic case lies in financial funds that make a quarter of a percent a year.

All your posts are talking about 10% Yield..As if it's guaranteed or it's the minimum

Ahla Post and excellent access to the investment world.

Successfully !!

Achla Post.

But the ancient graphs 2014-2017 and do not reflect a current snapshot.

Investment details

There are a number of non-negotiable investment channels such as p2p, hard money and investment funds that enable a good return on risk / good chance.

Nir, a great post with value, is backed by professional graphs.

Dude your every championship post. Do you feel like talking to me from my mind or reading my big brother who taught me the field? Well done?

What's right is right!