Home Sales Surge in Florida as California Markets saw two-digit annual declines in March ...

Home Sales Surge In Florida As California markets saw two-digit annual declines in March

Sales and house prices have dropped from year to year in San Francisco,

San Jose and Orange County as housing activity soared in the metro

With lower house prices and a tax burden

U.S. house prices did not change nearly in March,

Ticking down at 0.1 percent a year ago, for the median of

$ 295,100 across Metro Redfin Strips. Despite this, barely

Recorded as a decline, this is the first price per year

Decline on record since February 2012, when the median home

The sale price bottomed out at $ 171,600.

Only nine of 85's largest metro areas are leaking strips and a saw

Annual decline of the median price, including 13

Percentage decrease in San Jose a

1 percent of the dip in San

Francisco. At the same time, these expensive and other expensive

Beach markets, including Los Angeles,

orange

County and Seattle

A double-digit decline in the number of years compared to the number of dwellings sold

On time

Home Sales Surge in Florida as California Markets See Double-Digit Annual Declines in March

Home sales and prices fall year over year in San Francisco,

San Jose and Orange County as housing activity surged in metros

with lower home prices and tax burdens

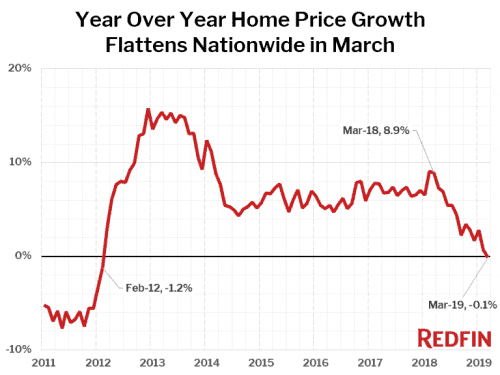

US home-sale prices were essentially unchanged in March,

ticking down by 0.1 percent from a year ago, to a median of

$ 295,100 across the metros Redfin tracks. Despite this barely

registers as a decline, it's the first year-over-year price

decrease on record since February of 2012, when the median home

sale price bottomed out at $ 171,600.

Only nine of the 85 largest metro areas Redfin tracks saw a

year-over-year decline in their median price, including a 13

percent drop in San Jose and a

1 percent dip in San

Francisco. At the same time, these and other expensive West

Coast markets, including Los Angeles,

Orange

County, and Seattle posted

double-digit year-over-year declines in the number of homes sold

while several large affordable markets on the East Coast saw big

annual sales gains. As housing market activity shifted from more to

less expensive places, the median price (which is the midpoint of

all sales) shifted to reflect the homes that sold last month.

"Homebuyers have backed off in West Coast metros where home

prices have risen far out of their budgets, "said Redfin chief

Economist Daryl Fairweather. "The opposite is happening in

more affordable metros where buyers are eager to buy now to take

advantage of low mortgage rates. In California, where the tax

burden is high, some people are finding they have to

move out of state to afford to buy a home. As a result, home

sales are down in metros throughout the state. "

Much like the national home price chart, the headline number

that sales increased 2 percent masks a lot of variation among metro

areas. The number of homes sold actually fell in 37 of the 85

largest metro areas that Redfin tracks. Meanwhile, 24 metro areas

saw double-digit increases in home sales compared to a year

earlier.

What's important is where home sales fell versus where home

sales increased. Compare the median prices of the 10 metro areas

that experienced the largest increases in home sales compared to

last year with the 10 that saw the largest decreases in sales:

Biggest Gains in Home Sales

Biggest Declines in Home Sales

Rank

Metro Area

Year-Over-Year Sales

Median Price

Metro Area

Year-Over-Year Sales

Median Price

1

Camden,

NJ

56.2%

$180,000

salt Lake

City, UT

-21.0%

$320,000

2

Baltimore,

MD

34.5%

$255,000

The

Angeles, CA

-19.4%

$620,000

3

Allentown,

PA

24.9%

$184,700

All the

Vegas, NV

-18.8%

$280,000

4

Orlando,

FL

23.5%

$249,900

Orange County,

CA

-16.4%

$700,000

5

Newark,

NJ

22.7%

$328,900

Fresno,

CA

-16.0%

$275,000

6

Memphis,

TN

20.2%

$165,000

Oxnard,

CA

-15.6%

$600,000

7

Tampa,

FL

19.3%

$225,000

Seattle,

WA

-15.0%

$560,000

8

Warren,

MI

18.7%

$205,000

Riverside,

CA

-14.3%

$370,000

9

New

York, NY

18.2%

$383,625

San

Jose, CA

-14.3%

$1,115,000

10

Pittsburgh,

PA

16.7%

$162,000

San Francisco,

CA

-13.7%

$1,400,000

Average

$233,913

Average

$624,000

On average, the metro areas that saw the largest declines in

home sales were more than 2.5 times as expensive as the metro areas

where sales surged. The cheapest of the 10 metro areas where sales

declined (Fresno, $ 275,000) was still more expensive than eight of

the top 10 metros where sales surged.

"Salt Lake City and Las Vegas experienced rapid home price

growth in 2017 and 2018, "explained Fairweather. "Even though

these metros are still affordable to Californians, home sales are

often down because it has become harder for locals to afford to

buy homes. "

Market Summary

March 2019

Month-Over-Month

Year-Over-Year

Median sale price

$295,100

2.6%

-0.1%

Homes sold

259,100

39.1%

2.0%

New listings

353,400

27.9%

-2.8%

All Homes for sale

800,400

3.2%

3.6%

Median days on market

49

-10

1

Months of supply

3.1

-1.1

0.1

Sold above list

20.0%

1.6%

-4.5%

Median Off-Market Redfin Estimate

$299,000

0.3%

6.2%

Average Sale-to-list

97.9%

0.3%

-0.6%

The number of homes for sale at the end of the month was up 3.6

percent from a year earlier in March. The number of homes newly

listed for sale fell 2.8 percent from March 2018.

Of the 85 largest metro areas Redfin tracks, 46 saw an increase

in the number of homes for sale compared to a year earlier, with

the largest gains coming yet again in San Jose (+ 104.3%) and

Seattle (+ 82.9%). The metro areas with the largest declines in

homes for sale were Albuquerque

(-36.4%) and New Orleans

(-34.4%).

Home-selling sermons were large unchanged from a year earlier

nationally, increasing just one day to a physician of 49 days on

market. Again though, there was a significant variation among metro

areas, with 14 metro areas speeding up by 10 days or more from a

year earlier and 15 metro areas slowing down by 10 days or

more.

Many of the markets slowing down the most were clustered on the

West Coast, such as Orange

County (+ 18 days), San Diego

(+ 16 days), Los Angeles, (+ 15 days), Portland,

OR egon (+ 14 days), San Jose (+ 13 days) and Seattle (+ 12 days).

On the flip side, the markets speeding up the most were mostly

inexpensive metro areas on the East Coast or in the South Egypt

Midwest, such as New Orleans (-64 days), Knoxville,

Tennessee (-48 days), Philadelphia

(-29 days), Pittsburgh (-19 days), Atlanta (-16

days) and Indianapolis

(-13 days).

In March, 20.0 percent of homes sold above the list price, down

from 24.5 percent in March 2018. Meanwhile 22.5 percent of homes on

the market in March had a price drop, up from March 2018's share

of 20.2 percent.

Other March Highlights

Competition

Denver was the fastest market, with half of all homes pending

sale in just 15 days, up from 7 days a year earlier. Oakland, CA

and San Francisco were the next fastest markets with 16 and 19

median days on market, followed by Washington, DC (19) and Seattle

(19)

The most competitive market in March was San Francisco where

60.5% of homes sold above list price, followed by 52.3% in Oakland,

CA, 49.5% in San Jose, CA, 40.0% in Tacoma, WA, and 35.4% in

Minneapolis.

Prices

Camden, NJ had the nation's highest price growth, rising

12.7% since last year to $ 180,000. Milwaukee had the second highest

growth at 12.6% year-over-year price growth, followed by Dayton, OH

(12.1%), Detroit (11.5%), and Long Island, NY (11.2%).

9 metros saw price declines in March. San Jose, CA declined the

most since last year falling 12.9 percent to $ 1,115,000.

Sales

Camden, NJ led the nation in year-over-year sales growth, up

56.2%, followed by Baltimore, up 34.5%. Allentown, PA rounded out

the top three with sales up 24.9% from a year ago.

Salt Lake City saw the largest decline in sales since last

year, falling 21.0%. Home sales in Los Angeles and Las Vegas

reduced by 19.4% and 18.8%, respectively.

Inventory

San Jose, CA had the highest increase in the number of homes

for sale, up 104% year over year, followed by Seattle (83%) and

Salt Lake City (53%).

Albuquerque, NM had the largest decrease in overall inventory,

falling 36.4% since last March. New Orleans (-34%), Rochester, NY

(-27%), and Montgomery County, PA (-22%) also saw far fewer homes

available on the market than a year ago.

Redfin Estimate

The median list price-to-Redfin Estimated ratio was 95.4% in San

Francisco, the lowest of any market. Only 10.9% of homes in San

Francisco were listed for more than their Redfin Estimate.

Conversely, the median list price-to-Redfin Estimated ratio was

102.3% in Miami and 102.1% in West Palm Beach, FL, which means

sellers are listing their homes for more than the estimated value

in those metro areas. In Miami, 82.0% of homes were listed above

their Redfin Estimate, the highest percentage of any metro.

Below are market-by-market breakdowns for prices, inventory, new

listings and sales for markets with populations of 750 thousand or

more. For downloadable data on all of the markets Redfin tracks,

visit the Redfin

Data Center.

Median Sale Price

Redfin Metro

Median Sale Price

Month-Over-Month

Year-Over-Year

Albany, NY

$200,000

1.0%

2.4%

Allentown, PA

$184,700

-0.6%

-2.8%

Atlanta, GA

$242,100

5.3%

5.3%

Austin, TX

$305,000

3.4%

1.7%

Bakersfield CA

$235,000

1.8%

5.1%

Baltimore MD

$255,000

2.0%

-0.8%

Baton Rouge, LA

$198,500

0.8%

1.8%

Birmingham, AL

$205,000

10.8%

6.4%

Boston, MA

$472,000

4.8%

2.2%

Bridgeport CT

$363,300

10.4%

-0.5%

Buffalo, NY

$146,000

0.7%

5.8%

Camden, NJ

$180,000

6.5%

12.7%

Charlotte, NC

$245,700

4.6%

3.7%

C

$240,000

4.3%

0.4%

Cincinnati OH

$177,000

4.1%

5.4%

Cleveland OH

$145,000

6.0%

7.4%

Columbus, OH

$200,800

2.9%

8.5%

Dallas, TX

$295,000

3.5%

0.0%

Dayton oh

$129,900

6.5%

12.1%

Denver, CO

$408,600

2.2%

1.4%

Detroit MI

$128,200

8.2%

11.5%

El Paso, TX

$158,000

-3.1%

3.2%

Fort Lauderdale FL

$265,000

2.3%

6.0%

Fort Worth, TX

$245,000

4.3%

5.4%

Fresno, CA

$275,000

5.8%

5.8%

Grand Rapids, MI

$196,100

1.7%

4.6%

Greenville, SC

$206,900

3.5%

3.5%

Hampton Roads, VA

$220,000

0.0%

-2.2%

Hartford, CT

$205,000

6.0%

-2.3%

Honolulu, HI

$585,000

7.3%

4.8%

Houston, TX

$240,000

3.4%

2.6%

Indianapolis, IN

$180,500

6.2%

4.2%

Jacksonville, FL

$229,900

4.7%

2.2%

Kansas City, MO

$215,000

7.5%

4.8%

Knoxville, TN

$195,000

3.9%

2.6%

Las Vegas, NV

$280,000

1.8%

5.7%

Long Island, NY

$450,000

5.9%

11.2%

Los Angeles, CA

$620,000

2.9%

3.3%

Louisville, KY

$179,900

-4.1%

3.1%

McAllen, TX

$153,800

2.5%

9.0%

Memphis, TN

$165,000

0.6%

-0.9%

Miami, FL

$300,000

3.4%

1.7%

Milwaukee WI

$210,000

12.9%

12.6%

Minneapolis, MN

$275,000

5.8%

7.4%

Montgomery County, PA

$305,000

10.7%

5.5%

Nashville, TN

$288,000

2.9%

2.9%

New Haven CT

$199,900

2.3%

8.1%

New Orleans, LA

$210,000

2.4%

5.0%

New York, NY

$383,600

1.6%

3.7%

Newark, NJ

$328,900

1.2%

6.1%

Oakland, CA

$735,000

5.0%

2.1%

Oklahoma City, OK

$178,000

1.7%

7.9%

Omaha, NE

$202,000

5.5%

10.4%

Orange County, CA

$700,000

3.1%

-1.4%

Orlando, FL

$249,900

0.0%

6.3%

Oxnard, CA

$600,000

4.5%

3.5%

Philadelphia, PA

$200,000

11.1%

6.7%

Phoenix, AZ

$270,000

1.0%

5.3%

Pittsburgh, PA

$162,000

7.3%

1.2%

Portland, OR

$392,000

0.5%

1.8%

Providence, RI

$267,500

4.9%

4.9%

Raleigh, NC

$285,000

-0.5%

1.8%

Richmond, VA

$250,000

9.2%

4.7%

Riverside, CA

$370,000

1.1%

4.2%

Rochester, NY

$137,500

6.0%

5.9%

Sacramento, CA

$395,000

1.9%

1.3%

Salt Lake City UT

$320,000

0.3%

2.6%

San Antonio, TX

$223,800

2.9%

4.1%

San Diego, CA

$565,000

0.9%

0.9%

San Francisco, CA

$1,400,000

9.4%

-1.2%

San Jose, CA

$1,115,000

6.2%

-12.9%

Seattle, WA

$560,000

2.7%

0.0%

St. Louis MO

$176,000

7.0%

5.1%

Tacoma, WA

$365,000

1.7%

4.3%

Tampa, FL

$225,000

0.0%

2.7%

Tucson, AZ

$219,000

1.5%

6.8%

Tulsa, OK

$165,000

5.1%

3.1%

Warren, MI

$205,000

9.7%

5.1%

Washington, DC

$390,000

2.6%

0.0%

West Palm Beach FL

$272,500

0.2%

0.0%

Worcester, MA

$250,000

3.1%

4.2%

National

$295,100

2.6%

-0.1%

Homes Sold

Redfin Metro

Homes Sold

Month-Over-Month

Year-Over-Year

Albany, NY

687

26.1%

-3.5%

Allentown, PA

854

48.3%

24.9%

Atlanta, GA

9,582

39.3%

0.0%

Austin, TX

2,803

22.1%

-5.5%

Bakersfield CA

698

35.3%

-8.4%

Baltimore MD

4,161

71.8%

34.5%

Baton Rouge, LA

913

33.1%

2.5%

Birmingham, AL

1,526

44.9%

6.9%

Boston, MA

3,164

31.6%

0.2%

Bridgeport CT

805

33.5%

5.1%

Buffalo, NY

702

13.2%

-3.7%

Camden, NJ

2,129

51.7%

56.2%

Charlotte, NC

3,480

37.6%

0.2%

C

8,013

44.6%

-2.7%

Cincinnati OH

2,009

34.2%

-1.3%

Cleveland OH

2,115

33.5%

-8.4%

Columbus, OH

2,590

66.8%

10.9%

Dallas, TX

5,351

31.2%

-5.5%

Dayton oh

1,027

62.0%

13.2%

Denver, CO

4,805

50.8%

10.7%

Detroit MI

1,704

11.4%

10.1%

El Paso, TX

691

29.9%

3.9%

Fort Lauderdale FL

3,286

66.4%

1.2%

Fort Worth, TX

2,913

28.7%

0.4%

Fresno, CA

695

42.7%

-16.0%

Grand Rapids, MI

1,231

39.6%

8.2%

Greenville, SC

1,192

42.1%

15.7%

Hampton Roads, VA

2,253

45.4%

11.2%

Hartford, CT

1,037

40.5%

7.2%

Honolulu, HI

748

43.8%

-6.1%

Houston, TX

7,181

32.1%

-0.2%

Indianapolis, IN

2,575

35.5%

-5.4%

Jacksonville, FL

2,630

46.1%

14.0%

Kansas City, MO

2,460

31.9%

-12.9%

Knoxville, TN

1,173

40.6%

6.8%

Las Vegas, NV

3,243

29.4%

-18.8%

Long Island, NY

2,349

1.2%

-5.7%

Los Angeles, CA

5,170

36.8%

-19.4%

Louisville, KY

1,362

51.2%

9.4%

McAllen, TX

246

3.8%

-8.6%

Memphis, TN

1,228

45.0%

20.2%

Miami, FL

3,087

63.3%

14.5%

Milwaukee WI

1,536

47.6%

5.9%

Minneapolis, MN

4,415

47.7%

15.6%

Montgomery County, PA

2,011

46.7%

14.7%

Nashville, TN

3,377

45.4%

10.8%

New Haven CT

733

33.8%

7.5%

New Orleans, LA

1,214

27.7%

14.5%

New York, NY

7,317

30.8%

18.2%

Newark, NJ

2,297

34.1%

22.7%

Oakland, CA

2,002

41.5%

-12.8%

Oklahoma City, OK

1,986

56.7%

14.1%

Omaha, NE

881

12.4%

-6.1%

Orange County, CA

2,187

42.8%

-16.4%

Orlando, FL

4,607

55.1%

23.5%

Oxnard, CA

608

24.1%

-15.6%

Philadelphia, PA

1,918

41.8%

6.5%

Phoenix, AZ

8,093

30.4%

-13.7%

Pittsburgh, PA

2,143

61.6%

16.7%

Portland, OR

2,820

22.7%

-9.3%

Providence, RI

1,415

31.0%

-1.9%

Raleigh, NC

2,278

33.1%

6.7%

Richmond, VA

1,618

53.8%

4.1%

Riverside, CA

4,378

32.1%

-14.3%

Rochester, ..——————————————————————

Mon, 22 Apr 2019 22: 39: 30 + 0000

US Real Estate News - Post automatically translated 2 - English version

To post questions about real estate in the United States now join the Real Estate Group and interest - United States Real Estate Forum:

www.facebook.com/groups/ForumNadlanUSA

----------------------

Home sales and prices fell year over year in San Francisco, San Jose and Orange County as housing activity surged in metros with lower home prices and tax burdens US home-sale prices were essentially unchanged in March, ticking down by 0.1 percent from a year ago , to a median of $ 295,100 across th…

The original responses to the post can be read at the bottom of the current post page on the site or in the link to a post on Facebook and of course you are invited to join the discussion

Responses